What is exit planning? What does it entail?

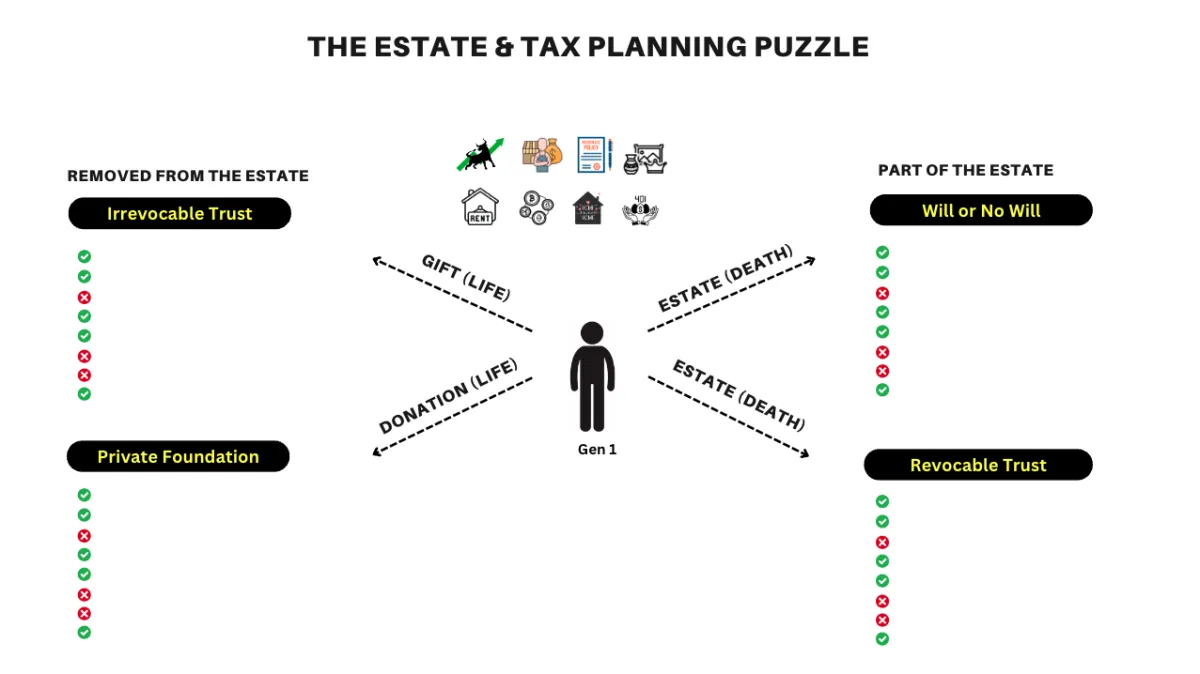

Exit planning involves strategically preparing to sell or transfer ownership of an asset to maximize financial outcomes while minimizing tax liabilities. There are several factors to consider when selling an asset, from legal implications, risk mitigations, tax obligations, and estate planning implications.

Utilizing trusts, private foundations, and other advanced strategies can significantly defer, lower, or avoid capital gains and recaptured depreciation taxes. We offer robust strategies and techniques for various asset classes, including primary homes, investment properties, public stocks, cryptocurrency, and other investments.

How can I avoid, lower, or defer the capital gains taxes on the sale of an asset?

That's the multi-million dollar question that every entrepreneur or investor wants to know! On this page, we'll explore the different startegies and legal methods available to individuals looking to sell an asset and the least amount of taxes and costs - legally!

Before digging deeper, let's take a quick second to review the terms, definitions, and concepts that impact liquidating an asset:

8 Key Terms and Concepts

1031 Exchange: A swap of one investment property for another that allows capital gains taxes to be deferred (certain conditions need to be met in order to qualify).

Charitable Remainder Trust (CRT): A trust that provides income to the donor or other beneficiaries for a specified period, with the remainder going to charity.

Donor-Advised Fund (DAF): A charitable giving vehicle that allows donors to make a charitable contribution, receive an immediate tax deduction, and recommend grants from the fund over time.

Grantor Retained Annuity Trust (GRAT): An estate planning tool that allows individuals to make large financial gifts to family members while minimizing tax liability.

Irrevocable Life Insurance Trust (ILIT): A trust designed to own a life insurance policy to remove the death benefit from the estate for tax purposes.

Dynasty Trust: A trust designed to pass wealth down through multiple generations without incurring transfer taxes.

Private Foundation: A charitable organization created by a single benefactor or a small group of donors, primarily for managing their charitable giving and providing significant tax benefits.

Stepped-Up Basis: A tax provision that adjusts the value of an inherited asset to its fair market value at the date of the decedent's death, minimizing capital gains taxes when the asset is sold.

Here are the different types of assets that can be liquidated or sold and 5 different exit planning strategies that can be deployed to lower taxation

5 Ways to Lower Taxes When Selling Your Primary Home:

Home Sale Exclusion: Exclude up to $250,000 ($500,000 for couples) of capital gains if you’ve lived in your home for two of the last five years. We highly recommend combining this with estate planning strategies to ensure legal protection.

Transfer to a Trust: Place your home in a revocable living trust before selling to manage estate taxes and streamline proceeds transfer while retaining eligibility for the exclusion.

Donate to a Foundation: Donate the property or a portion of the sale proceeds to a private foundation to avoid capital gains tax on the donated amount and gain a charitable deduction.

Charitable Remainder Trust (CRT): Use a CRT to sell your home, deferring capital gains tax. You receive income from the trust, with remaining assets eventually going to a charity.

Family Trust (QPRT): Transfer your home to a family trust to reduce gift taxes, lower estate taxes, and benefit your heirs while retaining the right to live in the home for a period.

5 Tax-Saving Strategies for Selling an Investment Property:

1031 Exchange: Defer capital gains taxes by reinvesting the proceeds into a similar property through a 1031 exchange.

Opportunity Zone Investment: Reinvest gains into a Qualified Opportunity Zone to defer and potentially reduce capital gains taxes.

Installment Sale: Spread out the tax liability by selling the property through an installment sale, receiving payments over time.

Transfer to a Trust: Place the property in a trust before selling to manage estate taxes and potentially defer capital gains.

Donate to a Foundation: Donate the property to a charitable foundation to avoid capital gains tax and gain a charitable deduction.

5 Tax-Saving Strategies for Selling Public Stock:

Donate Appreciated Stock: Donate stock to a foundation to avoid capital gains taxes and claim a deduction for the full market value.

Charitable Remainder Trust (CRT): Use a CRT to sell stock, deferring capital gains taxes while receiving income from the trust.

Tax-Loss Harvesting: Offset gains by selling other stocks at a loss to reduce your overall tax liability.

Transfer to a Family Trust: Move stock into a trust before selling to manage taxes and pass on wealth efficiently.

Gifting Stock: Gift stock to family members in lower tax brackets to reduce the tax impact on capital gains.

5 Tax-Saving Strategies for Selling Crypto or Other Assets:

Donate Crypto: Donate appreciated cryptocurrency to a foundation to avoid capital gains taxes and receive a charitable deduction.

Crypto Tax-Loss Harvesting: Offset gains by selling other cryptocurrencies at a loss, reducing overall tax liability.

Crypto CRT: Place your cryptocurrency in a Charitable Remainder Trust to sell tax-free and receive ongoing income.

Hold for Long-Term Gains: Hold the asset for over a year to benefit from lower long-term capital gains tax rates.

Transfer to a Trust: Move crypto into a trust before selling to optimize tax management and estate planning.

5 Tax-Saving Strategies for Selling a Business:

Installment Sale: Spread out the tax liability by selling the business through an installment sale, receiving payments over time.

Qualified Small Business Stock (QSBS): If eligible, exclude up to $10 million or 10 times your basis from capital gains taxes.

Donate Business Assets: Donate part of the business or proceeds to a foundation to reduce capital gains and get a charitable deduction.

Business CRT: Place the business in a Charitable Remainder Trust to sell tax-free and receive ongoing income.

Opportunity Zone Investment: Reinvest sale proceeds into an Opportunity Zone to defer and potentially reduce capital gains taxes.

5 Tax-Saving Strategies for Cashing in Retirement Funds

Roth IRA Conversion: Convert traditional retirement funds to a Roth IRA to pay taxes now and avoid taxes on future withdrawals.

Charitable Donations: Use required minimum distributions (RMDs) for charitable donations to reduce taxable income.

Timing Withdrawals: Withdraw funds in a low-income year to reduce the tax impact.

Qualified Charitable Distributions (QCDs): Direct RMDs to charity tax-free, reducing taxable income.

Transfer to a Trust: Use a retirement trust to manage and distribute retirement assets tax-efficiently.