Services we offer

Estate & Tax Planning and Strategies

Simple and advanced estate and tax planning strategies for business owners, individuals, investors, C-Suite Executives, and families looking into estate planning.

Strategic Philanthropy & Impact Investing

Strategic philanthropy and impact investing or individuals looking to "control wealth, not own it" through the strategic use of foundations.

Mini Family Office Strategic Services

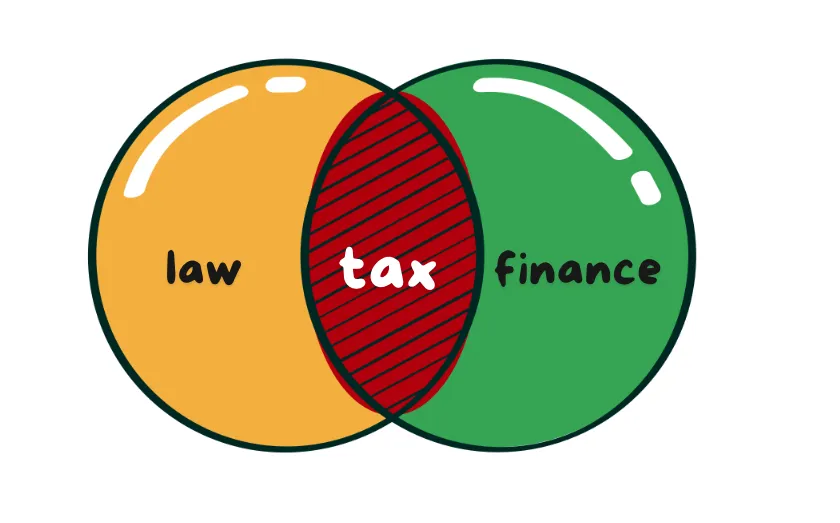

Mini Family Office™ Strategic Services which creates a centralized wealth management system that aligns all your law, tax, and finance teams together.

Business succession & preservation strategies

We offer business consulting and succession strategies for small businesses that want to pass their companies or shares to heirs

Tax-Savvy Asset liquidation and exits

We assist with the strategies revolving around the liquidation or sale of an asset, whether personal, investment, business, or even inherited assets

LLC, INC, partnership, and 501c3 Nonprofit Filings

We offer a range of strategic and filing services that cover partnerships, limited liability companies, incorporations, and nonprofit organizations